Category Archives: Market Talk

Trading Update. 17 Trades 17 Winners 461.7 pips.

I have not done a weekly trading update for a long time so I thought I would share last weeks trades with you. There are a few of what I call breakeven trades which are trades that only yield a few pips. But as you can see from the list below I had 17 trades with 17 winners and a total pip count of 461.7.

I have not done a weekly trading update for a long time so I thought I would share last weeks trades with you. There are a few of what I call breakeven trades which are trades that only yield a few pips. But as you can see from the list below I had 17 trades with 17 winners and a total pip count of 461.7.

All these trades can be verified with a trading statement if required. Just drop me an email if you want to see the trading statement.

Sold GBP YPY at 14698.8. Closed at 14544.4. Profit 154.4 pips.

Sold GBP USD at 13260.9. Closed at 13210.8. Profit 50.1 pips.

Sold USD CAD at 13227.8. Closed at 13197.7. Profit 30.1 pips.

Bought AUD JPY at 81.193. Closed at 81.231. Profit 3.8 pips.

Bought AUD JPY at 81.918. Closed at 82.036. Profit 11.8 pips.

Bought AUD USD at 0.73957. Closed at 0.74030. Profit 7.3 pips.

Bought GBP JPY at 14479.4. Closed at 14501.6. Profit 22.2 pips.

Bought GBP JPY at 14463.2. Closed at 14503.6. Profit 40.4 pips.

Bought CAD JPY at 82.825. Closed at 83.175. Profit of 35 pips.

Bought AUD USD at 0.73900. Closed at 0.73931. Profit 3.1 pips.

Sold USD CAD at 1.32920. Closed at 1.32880. Profit 4 pips.

Bought GBP JPY at 14475.1. Closed at 14478.1. Profit 3 pips.

Sold USD CAD at 1.33245. Closed at 1.333143. Profit 10.2 pips.

Bought CAD JPY at 82.692. Closed at 82.879. Profit of 18.7 pips.

Sold GBP USD at 13281.1. Closed at 13278.6. Profit 2.5 pips.

Sold EUR USD at 1.16662. Closed at 1.16395. Profit of 26.7 pips.

Bought CAD JPY at 82.384. Closed at 82.768. Profit of 38.4 pips.

Total pips for the week. 461.7.

If you are struggling with your trading and want to get similar results to these please then consider one of my Forex training courses. Thanks for visiting. Have a great day.

To Hike Or Not To Hike? That Is The Question.

The Fed have been a little more hawkish of late, and with good reason in my opinion. The numbers coming out of the US have been good enough for a rate hike this year.

August NFP numbers were released on Friday which came in at a 151k against an expected 180k. So with NFP numbers below market expectations, will the Fed hike rates in September? Lets have a look at what some of the major players have to say.

Not Strong Enough For A September Hike – Danske

Overall, the August jobs report was not strong enough for the Fed to hike at the next meeting in September, especially not after the very weak ISM report released yesterday, with the index falling below 50, indicating a contraction in the US manufacturing sector.

Although our view is that the Fed will stay on hold until H1 17, we cannot rule out a hike later this year, most likely in December following the presidential election, if we see some recovery in the US activity data and continued decent jobs growth in coming months.

One main reason we moved our expectation for the next Fed hike to next year was due to Brexit but, so far, the economic impact of Brexit has been very limited in the rest of Europe and the US. Still, as we have argued for some time, most voting FOMC members have a dovish-to-neutral stance on monetary policy and would rather postpone the second hike than hike prematurely, although some FOMC members (especially non-voters) appear to be eager to get going with the hiking cycle. The Fed can afford to stay patient, as GDP growth has been just around 1% for three consecutive quarters, PCE core inflation is still below 2%, inflation expectations (both survey based and market based) have fallen and wage inflation is still subdued.

Good Enough For A September Hike – BNPP

In August, 151,000 jobs were added, below consensus expectations for 180,000. The three-month average gain (232,000) far exceeds the range of estimates the FOMC sees as sufficient to keep the unemployment rate stable.

There is nothing in this report that flashes a warning signal about where the economy is going; very different from the May report that caused a scare. We see this as a solid employment report that is good enough for the FOMC to deliver a rate hike in September.

For the month of August, hiring in the goods sector was weak while the services sector normalized a bit after an outsized gain in July.

The tendency for August payrolls to disappoint is no secret. Downside surprises are usually followed by large upward revisions in the Bureau of Labor Statistics’ (BLS) second and third estimates (an average revision of 62,000 in the past five years).

Feeling Weak: Keeping Our Fed Call For December Hike – BofA Merrill

The August employment report was weak, leaving us feeling comfortable with our call for the Fed to stay on hold in September and hike again in December.

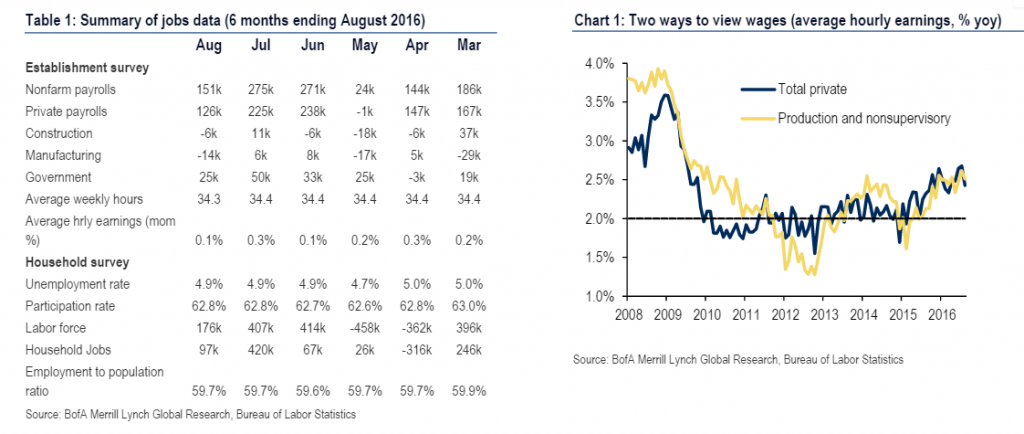

Nonfarm payrolls expanded by 151,000. July was revised up to 275,000 from 255,000 but June was revised lower to 271,000 from 292,000, leaving net revisions at only -1,000. Average hourly earnings only rose by 0.1% mom, causing the year-on-year rate to slow to 2.4% from 2.7%. Weekly hours also contracted to 34.3, down from 34.4 in the prior month (revised from 34.5 initially). The unemployment rate remained unchanged at 4.9%, as did the participation rate at 62.8% and the underemployment rate at 9.7%.

Labor Markets Squeak Past Threshold For September Hike – Barclays

Nonfarm payroll growth came in at a solid 151k in August, below our forecast (200k) and that of consensus expectations (180k). The establishment survey softened a bit across the board, but continues to show solid underlying strength. The three month average gain in payrolls is now 232k. Goods sector employment fell 24k, consistent with softening in some survey indicators in recent data. Service sector employers added 150k; these private sector gains were further boosted by 25k in government job gains. The household survey shows an unemployment rate unchanged at 4.9%, as robust household employment was offset by a further rise in labor force participation. Finally, wage growth (0.1% m/m, 2.4% y/y) also softened a touch from last month.

On the whole, this morning’s strong July employment report, despite the slower pace of job gains, indicates that labor market health remains intact and that therefore economic activity remains solid. Furthermore, this print should maintain the confidence of most FOMC members in the outlook. Most members will view this report as consistent with solid economic activity and will believe that that activity will continue to pull inflation upward toward their target.

We maintain our call of a September rate hike.

So there you have it. 2 calls for a September hike, and 2 calls for no hike. The odds of a September hike are currently just over 40% so its very close and could go either way.

If you like this article please share it. Thanks for visiting, have a great day.

Forex Volume Set To Rise. USD JPY To Stabilize – Credit Agricole.

Article Courtesy of Credit Agricole.

The views expressed in this article are the opinion of Credit Agricole FX market analysts. Please feel free to share.

The holiday season is in full swing and for some this may mean that markets will settle down as liquidity dries up in the coming weeks.

Our evidence suggests that Forex volume tends to go up in August, however, data releases and events can trigger renewed spikes of short-end vol across G10. It remains to be seen whether the combined effect of the multitude of idiosyncratic shocks will be sufficient to fuel a broader risk off move. Even so, we have added to our portfolio a long XAU/CHF trade as a risk-off hedge. Another interesting strategy is to identify cheap FX volatility to benefit from accentuated market moves on the back of event risks and thin market liquidity ahead.

Next week’s data calendar is laden with data releases like US non-farm payrolls, and events like the BoE Inflation report and the RBA policy meeting.

The BoE inflation report may struggle to exceed the dovish market expectations ahead of the August inflation report, and that could help GBP consolidate more broadly. We remain long GBP/CHF going into the release. Investors are looking for another solid US payroll and earnings data.

JPY should remain in the spotlight ahead of the announcement of Abe’s fiscal stimulus next week. We expect Japanese stocks to recover some more as a result and that should help USD/JPY stabilize.

Ahead of the RBA, markets see a greater than 50% chance of a rate cut. We also see a non negligible risk of policy action and stick to our tactical AUD/USD short. The FX options markets do not seem to be pricing in a significant scope for spot moves making AUD short-term gamma an interesting buy as well.

That said, we remain bulls on AUD/NZD over the longer-term, and expect the upcoming NZ unemployment and inflation expectations data to fuel rate cut expectations ahead of the August RBNZ meeting, and keep the cross supported. Potential disappointments from Chinese PMI data could keep both antipodean currencies under pressure against USD.

FOMC Minutes Preview.

BofAML: The dichotomy between dovish remarks from Fed Chair Janet Yellen and more hawkish comments by several of her colleagues on the Federal Open Market Committee (FOMC) sets the stage for the March minutes. The shift lower in the dot plot was accompanied by modest downward revisions to the outlook, with an outright majority of FOMC participants expecting just two hikes this year. At the same time the Committee was unable to agree on a balance of risks, and the mixed messages of post-meeting speeches suggests underlying disagreement. Thus the minutes may give important insight into the nature and degree of discord, particularly among the voting members. We expect the minutes to sound somewhat more hawkish than Yellen’s recent remarks, if for no other reason than more hawkish views will be represented.

The market’s primary focus will be on the likely timing of the next rate hike. We expect most Fed officials to support keeping every meeting “live,” as well as for several to suggest that hiking at one of the next few meetings could be likely under their forecasts. The main division among the participants should be the assessment of risks, particularly around global economic and financial developments. Details about those concerns would be noteworthy. So too would be any indication of whether a majority saw on net balanced or downside risks. If the main concern was that the outlook had recently become more uncertain, that could fade in plenty of time for a June hike. The other big issue will the inflation outlook. Despite the recent rise in core inflation rates — which would seem to exonerate the FOMC’s long-held view that low inflation was “transitory” — Yellen has noted the slippage in inflation expectations and residual slack in the labor market. These factors likely contributed to her lack of conviction. How widely shared her skepticism on an inflation pickup are will be notable as well, as that should strongly influence the pace of rate hikes.

Finally, discussion of a slower trend rate of productivity growth would be noteworthy. With slower productivity growth, the terminal funds rate may be lower while inflationary pressures and thus the speed of normalization would be faster. Yellen alluded to some debate on the FOMC regarding this issue, but so far Fed officials do not appear to have embraced this possibility. We think that could happen over time, which could materially change market expectations for the tightening cycle.

Barclays: We look to the minutes of the March FOMC meeting to provide context for the surprisingly dovish policy statement and downward revision to the median path of the dots. Several regional Federal Reserve Bank presidents have noted that the April meeting remains “live” for rate hikes if the data hold up. Since then, however, Chair Yellen indicated that she sees downside risks to the outlook stemming from abroad. “Live” need not equate to probable.

We expect the minutes to provide a clue as to whether the March policy statement, which again refrained from characterizing the balance of risks, represents a compromise between a more dovish Chair and relatively hawkish committee members. That is, we look once again to the minutes to judge the extent to which the committee remains sharply divided between those who would prefer rate hikes and those who would prefer for policy to remain on hold

RBS: The Fed Funds rate “dot plot” chart revealed that most FOMC members revised down their expectation for the appropriate path of the Fed Funds rate in March. But even if most members saw it appropriate to submit a more accommodative path for the Fed Funds rate, there does appear to be a rift of sorts between members over how strong the impact of a global growth slowdown will have on growth at home.

The March meeting minutes, which detail the discussion and debate at the meeting, may appear more balanced than Chair Yellen’s press conference as it will include the cautious views taken by many on the leadership and some of the more constructive outlooks taken by regional Fed Presidents.

But even so, given Chair Yellen’s dovish press conference in March reflected the view of the committee as a whole and most members felt it was appropriate to revise their dots lower, the core takeaways from the minutes may lean dovish.